Temporary learner cover offers flexible, affordable insurance from 7 to 90 days, protecting car owners NCD, it avoids curfews, and helps teens get ready for their test.

Read the full article: Temp learner cover: 5 reasons it’s the smartest choice for teens learning to drive

Learner driver insurance

Flexible short-term learner driver cover from less than £2 per day.

Helping your children get ready for their driving test.

Our Learner Driver Insurance helps your child build confidence and their driving skills by letting them practise in your car.

Why choose learner driving insurance from The Green Insurer

Earn as you learn!

![]()

Our exclusive rewards portal is packed with discounts, offers and freebies.

Always be covered.

![]()

You can choose to always have cover, with continuous cover. Your cover extends once it expires by 7 to 90 days - your choice.

Your carbon is offset.

We’ll offset your carbon emissions and reward you for driving in a greener way as you learn to drive.

An affordable way to learn.

![]()

Our flexible insurance, means you only pay for the length of cover you need, from 7 to 90 days.

No risk to their NCD.

![]()

Your insurance is separate to the car owner's. If you need to make a claim it won't affect their (NCD) No Claims Discount.

No black box or curfews.

Just a helpful free app to help you improve your driving. There are no penalties or restrictions.

Practise what you have learnt in your driving lessons

Getting learner driver insurance on a friend or family member's car is a great way to boost your confidence, gain experience and pass your driving test quicker.

Our flexible learner driver insurance allows you to choose how many days insurance you need, from 7 to 90 days.

For policies over 30 days long, you can always cancel and get a refund of the insurer premium for any unused days over the 30-day minimum.

Get a learner driver quoteAre you a parent looking to insure a learner driver?

Discover the benefits of supplementing their driving lessons with learner driver insurance on a parents car.

Learn more about insuring a learner driverEarn as you learn!

With The Green Insurer's Learner Driver Insurance, you'll earn Green rewards as you practise or prepare for your driving test.

You can spend your Green rewards in our rewards portal, it's packed with discounts, offers and freebies.

We select as many brands as we can who have a similar ethos to us.

You can use your Green rewards to buy eGift cards or even as a credit towards your next insurance policy with The Green Insurer.

What's covered

- Damage to the car you are learning to drive in (insured under this policy)

- Death or injury to any other person, including passengers.

- Damage to other people's property up to £20,000,000.

- Damage to other people's vehicles.

What's not covered

- The first £250 of any claim (the compulsory excess).

- Windscreen repair/replacement.

- Foreign use.

Learner driver insurance blog

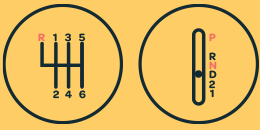

Not sure whether to learn to drive in a manual or automatic? We explore the pros, cons, pass rates and future trends to help you decide what’s right for you.

Read the full article: Should I learn to drive an automatic or manual?Not sure how long your provisional licence lasts or what to do if it runs out? Here’s everything learner drivers need to know in one handy guide.

Read the full article: How long does a provisional licence last?Learner driver insurance FAQs

Categories:

Policy and cover details

What is learner driver insurance?

Learner driver insurance is a short-term car insurance policy that covers a learner driver while they practise driving in someone else's car (often a parent or grandparent). It sits alongside the main annual insurance policy for the car and only covers the learner driver before they pass their driving test.

Do I get a refund if I cancel my learner driver policy?

You will get a pro rata refund of the insurance premium for any policy longer than 30 days. If you have a policy of longer than 30 days and cancel in the first 30 days, you will get a refund of the days over the 30-day minimum.

Find out when you’re eligible for a refund on learner insurance

How can I extend my learner driver policy?

You can renew your learner driver policy so long as you have not passed your driving test. We will send you an email telling you how to renew with your renewal premium. Renewing customers get a discount, so be sure to accept this renewal rather than buying a new policy.

See how to get a discount when renewing your learner insurance

How long does a learner driver insurance policy last?

Short-term learner driver insurance is available for any duration between 7 and 90 days. It is designed to cover the learner until they pass their test. It can be renewed once it ends provided that the learner driver has not passed their practical driving test.

How much is the Learner Driver policy excess?

The excess for our learner driver insurance is the same for all learner drivers and is £250 for any damage, fire or theft claim. This is a compulsory excess set by your insurer, and there is no option to increase or reduce this.

Is learner insurance comprehensive?

Yes, The Green Insurer's learner driver insurance is comprehensive. We do not offer third-party only or third party fire and theft options for our learner driver insurance. This means you are covered for damage to the car you're driving and for damage to other people or their property.

What happens to my learner insurance after I pass my test?

Learner driver insurance only covers you while you are learning to drive. Once you pass your driving test, you must stop driving until you have arranged insurance as a full driving licence holder. If you are driving someone else's car, ask them if they can add you to their policy.

What is covered with Learner Driver insurance?

The Green Insurer's learner driver insurance is a comprehensive car insurance policy. It covers you if you have an accident for damage to your own car and for injury to other people and damage to their vehicle or to their property.

Eligibility

Are there any age restrictions for learner driver policies?

Our learner driver insurance is available to learners aged 17-25 years old. Although there is no legal maximum age, we cannot cover any customers over 25. Our policy is designed especially for younger drivers and their parents, so we have not made it available to anyone over 25 just yet.

Can a 17 year old pay monthly for insurance?

Yes they can. Our flexible short-term learner driver insurance allows you to choose any length of cover from 7 days to 90 days. If you want to pay monthly, just choose a 30-day policy and add continuous cover. It will then automatically renew when the policy ends.

Find out how 17-year-olds can pay monthly for learner insurance

Can I still get learner insurance if I’ve failed my test before?

Yes, learner driver insurance is a great way to get in more practise before your next test. You may just need to brush up on a few things to pass next time. Some of the best drivers didn't pass first time. The pass rate is 48%, so you're not alone!

Can you get learner driver insurance with convictions?

For learner driver insurance with The Green Insurer, the learner driver must have no driving or criminal convictions. If you do have a driving conviction, you will need to wait until it is "spent" (usually 5 years for people aged 18 or over and 2.5 years for 17-year olds).

Do you need insurance to learn to drive?

Yes, anyone driving on a UK road must have car insurance in place. Learner drivers can either be a named driver on the car owner's policy or have their own separate learner driver insurance that’s linked to the car, such as The Green Insurer's learner driver insurance.

Parents and car owners

Can a learner driver drive my car?

To drive your car, any learner driver must be insured. They can either be a named driver on your policy or have their own separate learner driver insurance that’s linked to your car, such as the learner driver insurance offered by The Green Insurer.

Can a provisional driver be added to an existing annual policy?

Your current insurer may allow you to add a provisional driver to your existing annual policy. However, this may lead to a significant increase in your premium. Also, if the learner driver has an accident, this will affect your no claims discount. Why not take out learner driver insurance instead?

Learn why separate learner insurance could be the better option

Can anyone else drive the car using my learner driver policy?

No, The Green Insurer's learner driver insurance only covers one named learner driver. If you do have more than one learner driver in your household, you can always take out a policy for each learner, so that they can both learn to drive.

Do I need insurance to supervise a learner driver?

Yes, you must be insured on the car to supervise a learner driver. You are there to support the learner driver and as a backup should anything go wrong. So, you need to be insured and legally able to drive the car at any time while supervising a learner driver.

Does it affect the car owner's No Claims Discount (NCD) if I need to claim?

No, claims on your learner driver insurance policy don't affect the car owner's No Claims Discount (NCD). Claims can happen when you're learning to drive and the last thing you need is to worry about the car owner's NCD. It's a big reason to take out separate learner driver insurance.

Does the learner driver need to display L plates on the vehicle they are practising in?

Yes, by UK law, you must have an L-plate (or a D-plate in Wales) on both the front and back of the car you're learning in. They must be clearly visible, should have a red letter on a white background and must be the right size.

Who can supervise a learner driver?

Learner drivers must be supervised at all times when driving. The supervisor must be at least 25 years old. They must have a full driving licence for the type of car being driven (manual or automatic) and have held that valid licence for a minimum of three years.

Vehicle and driver setup

Can a learner driver be insured on a Company car?

Yes, The Green Insurer can offer learner driver insurance on a company car. As the learner driver policy is separate from the cars primary insurance policy, it does not affect the main primary policy, whether it is through your employee or from another insurance provider.

Can a learner driver be insured on a lease car?

Yes, The Green Insurer can offer learner driver insurance on a lease car. As the learner driver policy is separate from the cars primary insurance policy, it does not affect the main primary policy, whether it is through the lease company or from another insurance provider.

Can a learner driver be insured on more than one car?

Yes you can be insured on more than one car, but you'll need separate insurance policies for each car. If, for example, you want to be insured on both of your parents' cars, then you'll need to take out a separate learner driver policy for each car.

Can I buy a learner driver insurance policy if there is no annual cover on the vehicle?

No, the vehicle must be insured under a separate annual car insurance policy. Learner driver insurance is designed to allow a learner driver to drive on someone else's car just while they are learning to drive only. It is not designed for cars owned by the learner driver.

Can I get learner insurance on a car with insurance already?

Yes – you absolutely can. Adding a learner driver policy alongside your main car insurance offers significant advantages. Not only is it an affordable and flexible way to learn to drive, but also if the learner makes a claim whilst driving your car, it won’t affect your No Claims Discount.

Can more than one learner driver be insured on the same car?

Yes, more than one learner driver can be insured on the same car, but they must each have their own learner driver insurance policy. The Green Insurer learner driver policies cover just one learner driver, so each person will need their own learner driver insurance policy before practicing their driving.

How do I insure a learner driver?

To drive a car, any learner driver must be insured. They can either be a named driver on your annual car insurance policy or have their own separate learner driver insurance that’s linked to your car, such as the learner driver insurance offered by The Green Insurer.

Using learner driver insurance

Can a learner driver carry passengers while driving?

Yes, learner drivers can legally carry passengers. In fact learner drivers must carry one qualified supervising passenger, who must supervise them while they are practicing their driving. However, we would strongly recommend that learner drivers do not take any more passengers than the person who is supervising them.

Can I make changes to the details on my policy?

Yes, you can make changes to your learner driver insurance policy. So you if the car is sold, or you move house, call us and we will make the change for you. The good news is that there is no charge for making changes to your learner driver policy.

Can learner driver insurance be used to take my test?

Yes, our learner driver insurance covers you during your driving test. You will be supervised by the examiner, and we waive the requirement for a supervisor to be over 25 for driving test examiners. Just remember that as soon as you pass your driving test, your insurance will end.

Can you take your driving test in your own car?

Yes, as long as the car you are insured to drive it and you have the car owner's permission. Our learner driver insurance covers you during your driving test. Just remember that as soon as you pass your driving test, your insurance will end.

Learning to drive

Can learner drivers drive at night?

Yes, learner drivers can drive at night. There are no curfews with our learner driver insurance. You’re free to drive at night as long as you’re supervised by a qualified driver, aged 25 or over, who has held a full UK driving licence for more than 3 years.

Can learner drivers drive abroad?

No, learner driver insurance can only be used in the UK. Your provisional licence is not valid outside UK. The highway code may differ in other countries and many drive on the right-hand side of the road, so it's best to learn drive and pass your test in UK first.

Learn the rules on international driving for provisional licence holders

Can learner drivers go on a dual carriageway?

Yes, learner drivers can drive on dual carriageways so long as they have L plates on the car and are supervised by a someone over 25 years old who has a full driving licence. Driving tests can also include some time on a dual carriageway if there is one nearby.

How long does it take to learn to drive?

It usually takes around 40 hours of lessons with a driving instructor before you are ready to take your test, and then you may have a significant wait to get a driving test booked. So, it's not unreasonable to expect it to take a year or more.

Will I earn an NCD while learning to drive?

No, our learner driver policies do not earn no claims discount (NCD). As the maximum duration for learner driver insurance is 90 days, you won't have driven for 1 year before renewal. So, wait until you pass and then build up your valuable NCD once you are a qualified driver!